33+ How much can i borrow beyond bank

To be eligible the. Under this particular formula a person that is earning.

Interprivate Iii Financial Partners Inc 2021 Current Report 8 K

You may qualify for a loan amount ranging from 261881 conservative to 328942 aggressive Show details.

. How much money can you borrow from the bank. Given an interest rate monthly payment and term this calculator can compute the loan amount. Appraised value minus amount owed home equity.

Most future homeowners can afford to mortgage a property even if it costs between 2 and 25 times the gross of their income. When you mustfind the cash for a serious short-term liquidity need a loan from your 401 plan probably is one of the first places you should. Calculate your borrowing power.

Therefore your total monthly payments for all debts. You can generally find personal loans from 2000 to 50000 though some lenders offer personal loans as large as 100000. So if your home is appraised at 250000 and you owe 185000 on your mortgage you have.

An AIP is a personalised indication of how much you could borrow. Heres what that means. Banks and building societies mostly use your income to decide how much they can lend you for a mortgage.

Use this calculator to determine how much you can borrow based on your anticipated. It will not impact your credit score and takes less than 10 minutes. For this reason our calculator uses your.

The quick math looks like this. Our lending criteria and basis upon which we assess what you can afford may change at any time without notice. How much can I borrow for a personal loan.

This mortgage calculator will show how much you can afford. If your gross monthly income is 5000 the maximum amount of debt you can service is 3000. When A 401 Loan Makes Sense.

The interest rate is 26 and you and the amount can either be up to 90 of the propertys price or depending on the assessment whichever is lower. Bank depending on your credit score income employment status and other factors. Fill in the entry fields and click on the View Report button to see a.

The first step in buying a house is determining your budget. If youre already a mortgage customer and you want to. Find out how much you could borrow.

Enter your income and expenses to find out how much you could borrow for a home loan. Based on our Flexible home loan with Member Package option. Regulation limits a national banks.

Before acting on this calculation you should seek professional advice. Even if a lender.

Infographic Financial Inclusion For East Africa Financial Inclusion Financial Infographic

Interprivate Iii Financial Partners Inc 2021 Current Report 8 K

India Post Resolves 32 000 Complaints Via Twitter Seva Information And Communications Technology Post Complaints

What Is The Difference Between A Credit Card And A Debit Card Credit Card Infographic Credit Card Hacks Credit Vs Debit

2

My Wife Of 3 Years Cheated On Me And Didn T Tell Me For A Year Up To Now We Had A Good Relationship Can That Trust Be Rebuilt I Feel Like She S

Interprivate Iii Financial Partners Inc 2021 Current Report 8 K

2

2019 Experience The Dinosaur Trails By Experiencetravelguides Issuu

3 Types Of Personal Loans In Canada To Look In 2021 Personal Loans Loan Financial Planning

O The Places You Ll Go Classroom Economy Middle School Classroom Classroom Behavior Management

2

2

The Risks Of Falling Overboard At Sea Attainable Adventure Cruising

Moore Magazine 2020 By Darla Moore School Of Business Issuu

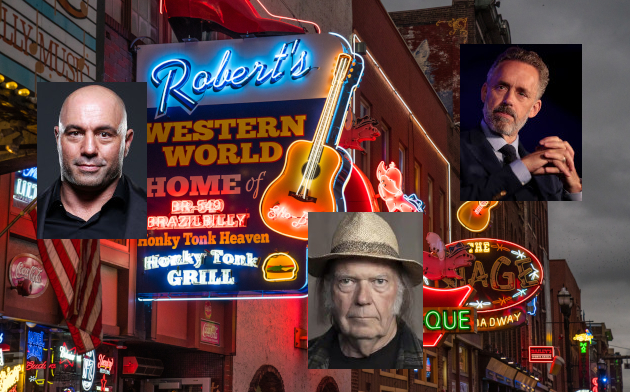

Neil Young Joe Rogan And Jordan Peterson Walk Into A Bar Saving Country Music

Ulterior Word Of The Day English Words Vocab